The Expanding Locum Tenens Market: The Business Aspect of Transitioning

© 2025 HMP Global. All Rights Reserved.

Any views and opinions expressed are those of the author(s) and/or participants and do not necessarily reflect the views, policy, or position of EP Lab Digest or HMP Global, their employees, and affiliates.

EP LAB DIGEST. 2025;25(5):22-23.

In a previous article in EP Lab Digest,1 I focused on the benefits and pitfalls of locum practice as well as how cardiac electrophysiology (EP) locums serve smaller communities. This article focuses on the increase in locum tenens utilization across the country and how it can fit into a physician’s practice. I will discuss the common business and tax structures utilized by physicians when they become independent contractors as a locum. The health care staffing market was valued at $22.5 billion in 2022 and is expected to compound at an annual rate of 5.7% until 2030 to address the growing physician shortages and staffing issues in the US health care system.2 It is estimated that approximately 52,000, or 7%, of the physician population eligible for locum work are providing locum services.3

Common reasons physicians transition or add locum work include:

• Supplemental income

• Control over schedule

• Search for full-time position

• Life transition

• Travel experience

• Bridge to retirement

• Avoid overwork

• Assist in health care where needed

Locum physicians can help provide continuity of patient care, prevent revenue loss, reduce staff burnout, and provide a “try out” period for candidates prior to a permanent offer. Concerns from the hospital perspective include higher cost than permanent physicians, lack of familiarity with practices and departments, quality concerns, lack of continuity of patient care, or lack of familiarity with equipment used for procedures.4 The telehealth locum tenens sector is also growing in popularity across the country, often as a side job for many employed physicians.

Deciding to change to locum work can be a difficult but rewarding decision in the right circumstances. Typically, the hours are established, but as with any procedural specialty, days can be longer than anticipated. Reimbursement is typically hourly with overtime. There is often a guaranteed daily pay offered with an hourly pay after a certain number of hours worked. Overnight and weekend call is sometimes required but may be optional and/or negotiable. The larger the area, the lower the pay, with rural areas offering the highest compensation. Searching for a suitable locum position can be daunting. However, networking with locum physicians is a good start. I was fortunate to have a connection with a retired EP physician providing services in my state who facilitated my hiring in Mason City, Iowa. Otherwise, utilizing an intermediary company can be helpful, as many hospital systems utilize these companies. There are numerous companies in competition across the country, with multiple job listings available. The same locum opportunities are usually offered by multiple companies. The benefit to the hospital system is that the companies provide reimbursement for travel and lodging, as well as provide malpractice insurance, tail coverage, and licensing. In my case, the hospital does not go through an intermediary company. They provide the malpractice and tail insurance. They also reimburse travel and lodging directly back to the physician.

Locum work can be quite feasible in the latter portion of a physician’s career, as locum physicians tend not to be involved in leadership, committee work, research, etc. For this reason, ongoing locum work may not be suitable for early or mid-career physicians who will require these elements to gain experience and establish a well-rounded career. Later career locum physicians tend to have experience in these areas, which can be helpful with understanding and integrating into situations with short-term placements. In addition, procedural volumes may be less overall for locum physicians. Therefore, it is beneficial to have a wide berth of experience when embarking on a locum career to have a well-rounded skill set, particularly when working in rural areas. Locums are typically expected to be able to immediately begin service, work with unfamiliar staff, and use equipment different than they are used to, with minimal mentoring. Locum physicians are also expected to “go with the flow” and seamlessly step into the job. This expectation may be difficult for a newer physician just starting out in the field who needs to establish themselves and feel confident in new cultures and environments while simultaneously gaining solid skill sets. Seasoned providers with more experience may find transitions a little easier. However, there is a growing trend for early and mid-career physicians to use locum work as a bridge to search for a full-time position.

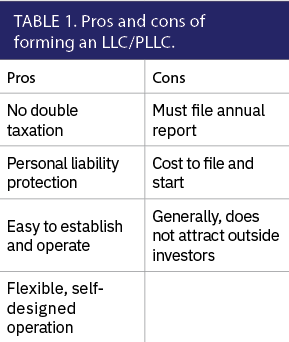

From a business perspective, the locum physician is typically an independent contractor as opposed to a partner or employed physician receiving a 1099 instead of W-2 for tax purposes. It is prudent to form a Limited Liability Company (LLC) or Professional Limited Liability Company (PLLC) to provide personal liability protection with certain tax advantages. In some states, professionals providing medical care are required to form a PLLC instead of an LLC. The LLC or PLLC is a legal business structure that offers the same protection as a full corporation without the formalities, paperwork, and annual filings needed to keep a corporation in good standing. It can be considered a simple and flexible structure that provides a barrier between the company and the owner, protecting the owner’s personal assets from the company’s debt. The LLC/PLLC does not protect the members from their own malpractice suits. The LLC/PLLC must adopt an operating agreement, the terms of which can be very flexible. The LLC/PLLC must appoint a registered agent, obtain an employer ID number (EIN), establish a business bank account, and name the company. It is prudent to keep personal and business expenses separate with as little intermingling as possible. All charges related to the business should go through the business account. This includes travel and food and lodging expenses related to work, as well as any items required to run the business such as office rental, equipment etc. A PLLC requires professional licensing for some or all members in the group, depending on the state. In California, professionals must apply for a Professional Corporation of Limited Liability Partnership. The costs to establish the LLC/PLLC include filing fees, annual fees for filing reports, and accounting and legal fees. The pros and cons are listed in Table 1.

In terms of taxation, the Internal Revenue Service (IRS) treats the LLC/PLLC and the owner as the same tax-paying entity, with all profits and losses passing through to the owner’s personal income tax return. This is quite different from other corporations. The profits are taxed at the owner’s tax rate, avoiding double taxation. The physician is responsible for paying local, state, and federal taxes including Medicare and social security taxes. The IRS requires that self-employed individuals pay both the employer and employee portion of the Medicare and Social Security taxes. The self-employment tax (Medicare and Social Security) is 15.3% to a maximum of $168,600 in 2024. The contracted locum physician will need to purchase health care and dental insurance as well as any other optional insurance such as long-term care and disability. Health care is typically purchased through an insurance broker with plans varying depending on the state.

The LLC/PLLC may choose to be taxed as an S corporation (S corp), where the member becomes employed by the PLLC and the S corp pays a reasonable salary to the owners. In most states, an S corp does not pay corporate income tax such as a C corporation (C corp) and the profits pass through to the owner’s personal tax returns. The physician’s S corp salary will be a portion of the annual profit of the PLLC, with only that portion of the company income subject to Medicare and Social Security Taxation. Any further payroll will be treated as distributions and only be subject to income tax, but not Medicare or Social Security tax. The IRS closely scrutinizes S corp owners. Therefore, creating an S corp can save money on taxes. However, in recent years, S corp owners classified salary as 0% and 100% of payout as distributions. The IRS became privy to this tax avoidance strategy and can impose hefty penalties if the owners are not paid a taxable salary. Therefore, the salary must be reasonable and commensurate to compensation of corresponding physicians in the geographic region. An S corp means more complicated tax withholdings, so accounting is more complicated, and thus, more expensive. Some tax deductions cannot be utilized in the S corp structure once the physician becomes an employee, so it is prudent to utilize an accountant with experience in this area. The pros and cons of forming S corp are listed in Table 2.

To qualify for S corp status:

• You must be a US business

• You cannot have more than 100 shareholders (owners)

• Shareholders cannot be corporations, partnerships, or nonresident aliens

• You can only have one class of stock

In terms of retirement savings, self-employed individuals have numerous choices. Locum physicians are typically sole owners and employees of their LLC/PLLC and S corps. A solo or self-employed 401(k) is available, which is like the plans available in many groups and large businesses. The maximum contribution is $23,000 in 2024 with a $7500 catch-up option for employees over 50 years of age. As the employer, the physician can contribute another 25% of the physician’s compensation. The maximum amount between these in 2024 was $76,500 for those over 50 and $69,000 for those under 50. There are other options available; however, this is the simplest for a sole owner/employee in a PLLC/S corp.

In summary, the physician-locum volume is expected to continue to grow over the next number of years. Physicians are transitioning for several reasons and this style of work can be beneficial to physicians, health care systems, and patients alike. Adopting to the locum lifestyle requires changes in work style, quick adaptations to new work environments, travel requirements, etc. Becoming an independent contractor can be challenging but also rewarding for many. It is necessary for physicians transitioning to the locum model to understand the various business models and tax structures available as an independent contractor.

Disclosure: The author has completed and returned the ICMJE Form for Disclosure of Potential Conflicts of Interest, and reports no conflicts of interest regarding the content herein.

References

1. Airey K. Alternate model of providing cardiovascular care: locum tenens. EP Lab Digest. 2024;24(9):18-19.

2. Wickstrom B. Experts predict strong locum tenens growth in 2023 despite healthcare headwinds complicating the US economic outlook. Locumpedia. Published April 7, 2023. Accessed October 28, 2024. https://www.locumpedia.com/news/2023-locum-tenens-industry-outlook/

3. 2023 State of Locum Tenens Report: A comprehensive look at the locum tenens industry. CHG Healthcare. Accessed October 28, 2024. https://chghealthcare.com/chg-state-of-locum-tenens-report-2023

4. 2024 State of locum tenens report: a comprehensive look at the locum tenens industry. CHG Healthcare. Accessed October 28, 2024. https://chghealthcare.com/chg-state-of-locum-tenens-report